Turning Around a Silver Lake Apartment Building: Lessons Learned

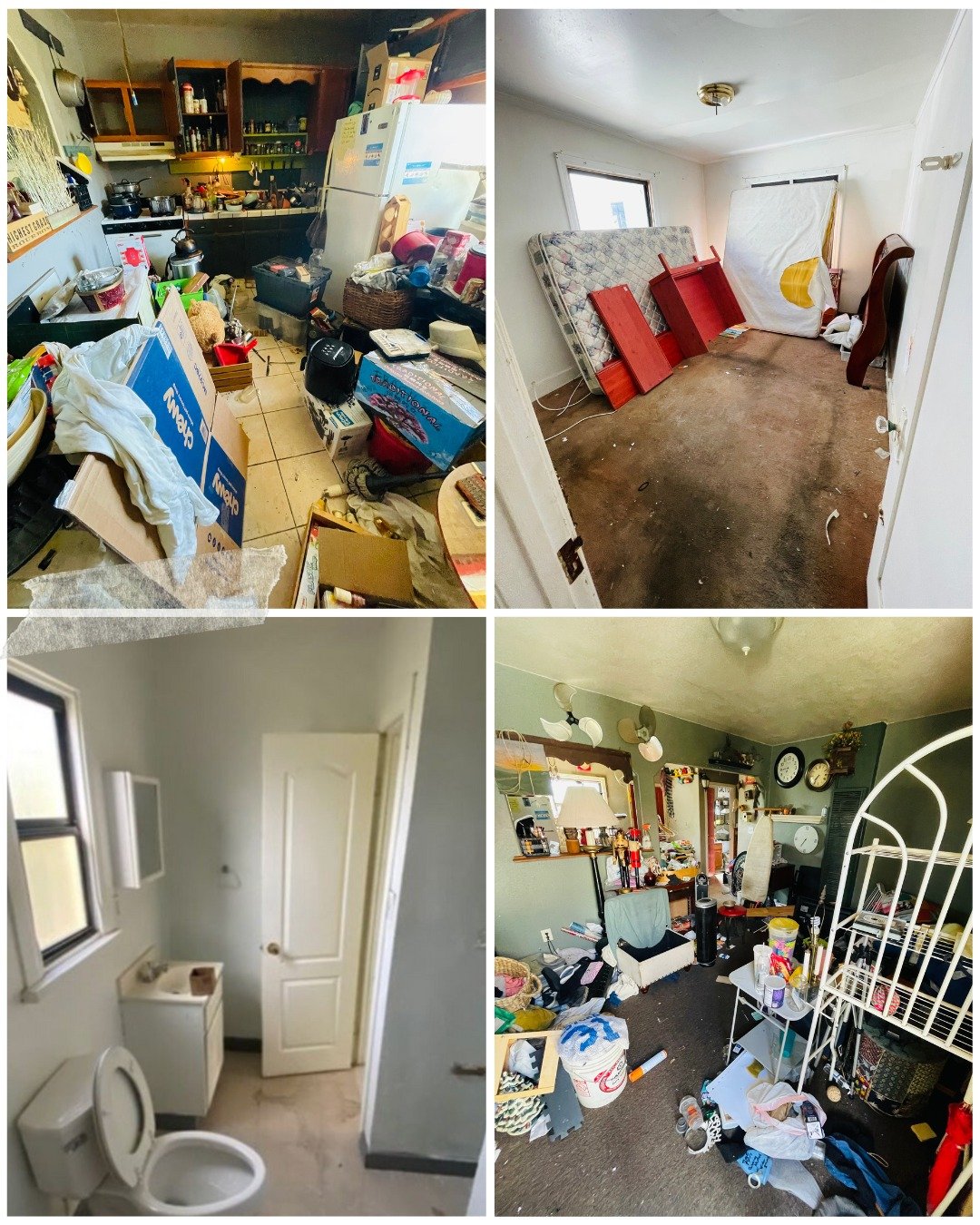

I vividly remember where I was—at a close friend’s wedding in Florida’s Panhandle—when in April 2023, I put a bungalow-style 8-unit property in Silver Lake into escrow. Rates had doubled about a year earlier, creating a challenging environment. Despite that, I was a buyer: I had purchased a duplex the previous year and was in escrow on another two-unit. This new purchase featured five vacant units and, despite its charming Spanish character, after years of neglect, the place was a dump. Drawn to this type of value-add opportunity, I holed up in the room between the wedding events, putting the deal together. Raising capital from silent partners was a key aspect of this story: I was using other people's money—along with some of my own—thereby raising the stakes and putting more weight on my shoulders to deliver.

The deal closed in May of 2023 and has faced numerous challenges along the way. Originally consisting of four bungalow duplexes totaling 8 units, we would turn it into a 10-unit property by adding two ADUs. As the General/Managing Partner, I was responsible for doing it all, and this included chasing Catholic Priests for access to their parking lot, meeting a garage squatter’s girlfriend who was surprised her partner wasn’t authorized to occupy our garages, and even being mistaken for Mormon missionaries. And we inhaled more second-hand pipe tobacco than Popeye, but what ultimately carried us through was resilience—playing the hand we were dealt and owning the project wholeheartedly until the finish line. Now with permanent financing secured and the property fully stabilized, I want to share what I’ve learned over the past two and a half years. Some things could have been done better initially, but it’s the choices we made that have allowed us to turn this project into a winner.

Let’s explore the five major lessons I’ve gleaned from this experience.

1. Location, Location, Location

Our initial business plan was to invest in this non-performing, value-add apartment building by pouring upfront capital—via a high-interest bridge loan—to upgrade the property until it was stabilized. Once upgraded, the goal was to generate enough income to qualify for a long-term loan, supported by a strong appraisal and the lender’s confidence in our stabilized income. That was our finish line—what we could never lose sight of.

The most well-known rule in real estate proved true every step of the way. Amid many surprises and obstacles, the most reliable factor was the property’s location—what I call “ground zero” in Silver Lake, just above Sunset Boulevard, near Alfred’s Coffee and Micheltorena Elementary. Although fully restoring and remodeling the property exceeded our initial budget, requiring capital calls and higher loan fees, once complete, the location’s strength helped us rent out all units at strong enough rates and secure the permanent financing.

To make the project work, we needed the rent from two additional units. To do this, we replaced the six garages with two ADUs, which meant several units would have no parking. In Los Angeles, this was a significant risk, but I gained confidence with every property visit. Standing out front, I saw vibrant hip, young professionals walking to Sunset Boulevard—Silver Lake has become “the place to be.” Tenants from other cities want this walkable, vibrant neighborhood with great amenities. Our well-designed, fully furnished units drew constant inquiries, and the high demand helped us hit our numbers and lease up to a fantastic community of tenants.

Takeaway: A good location is the foundation of success.

2. Partners

Coming off a very similar project in West Adams, I initially felt confident to proceed solo. But I soon realized the importance of having reliable support—whether through co-GPs or dedicated hires. In spring 2023, I was lucky to hire Thomas, a full-time associate with an entrepreneurial mindset and some real estate studies under his belt, who became my right hand. Thomas helped me handle everything from finance to permits, leasing, and legal matters, helping me stay organized and focused.

I was also fortunate to work with passive partners whose trust allowed me the freedom to run the project while benefiting from their insights—whether they provided advice or additional resources. The key is having partners who trust your expertise but also offer valuable perspectives.

Takeaway: Partner with support—whether through co-GPs or supportive LPs—to strengthen your ability to execute and adapt.

3. Turning Lemons into Lemonade (Grit)

The fact that this building had so much vacancy at closing was a plus. In Los Angeles, we have Rent Stabilization and Rent Control. Well-intentioned, it was designed so that Landlords cannot raise rents above the rate of inflation. But when rents are not raised for decades and a building transfers, the new owner is handcuffed and can never make up the rent gap (this creates a whole host of issues, including units becoming nearly uninhabitable, and ultimately worsening our housing shortage). In this case, we inherited three units, which on average pay $500 each per month. Two took a cash-for-keys deal, one of which rescinded his buyout agreement in the 11th hour; on the final day, he was able to do so. At that point, the investment didn’t pencil out unless we added two more ADU units to the property. Additionally, we had to raise the bar on how we would execute the other units and the property as a whole.

Taking a property that had been so neglected—and restoring it to showcase its original charm—is deeply fulfilling. For me, this process is more rewarding than building something entirely new. It’s like polishing a gem that has been tarnished over the decades—revealing its true beauty. But it's very hands-on, hard. Buildings can often be revived with just a fresh coat of paint, new doors, and a resurfaced floor. But this one required far more effort, creativity, and problem-solving.

The curveballs didn’t stop at just the reno. Instead of routine obstacles, it often felt like we were facing fastballs thrown straight at us.. As the insurance market grew increasingly complicated, carriers sent inspectors who mandated upgrades not only for the building but also for off-property improvements. We faced expenses like a $9,000 rebuild of a new sidewalk along 50 feet of our side street, exterior step repairs, breaker switches, handrails, concrete crack repairs, and more. Then, just as we thought we were at the finish line, nearing completion of the ADUs and waiting for DWP approval, we were blindsided again: they mandated that we upgrade the power drop, all the panels, and meters for the existing detached bungalows ($28,000). Need I say more about why the city faces such a housing shortage?

4. Build It, and They Will Come

In addition to location and architecture, interior design played a crucial role in achieving the rents needed to stabilize the property. Midway, I made a pivotal decision to replace the original materials selected by the previous owner’s architect—fixtures sourced entirely from Home Depot, which didn’t help the units stand out.. Instead, I brought in a designer/developer friend—also a former client—who found us a more refined, design-centric collection of finishes that accentuated the original Spanish character of the bungalows. It was a smart move. Thomas also suggested decorative tiles for the exterior step risers. The units, once completed, looked great, and we began hearing countless compliments from prospective tenants about the finishes and style. This attention to detail enabled us to command top rent for one-bedroom units in Silver Lake, attracting tenants who valued high-quality design and character, and ultimately proved to be a joy to work with.

5. Be Slow to Hire, But Quick to Fire

Words of wisdom from a mentor of mine, and a vital lesson from this project, was recognizing when to cut ties with underperforming contractors or service providers. If something isn’t working, it’s better to terminate the relationship sooner rather than later. I learned this the hard way—initially, I was slow to fire and prone to sticking out bad relationships. For instance, our first GC on the 6-unit rehab hit financial difficulties, became unprofessional, and left subs unpaid. That experience made me more cautious. Fresh off getting stung by that GC for central units, I had become more sensitive to the relationship we had begun with the ADU contractor. When every answer he gave was a near-incomprehensible novel and we were bogged down with change orders on the foundation in the first two weeks, we made the early decision to terminate.

Enter Juan Ceballos of AV Construction and Design, whom I met through a client. Juan delivered our two ADUs on time—completing them in nine months—and, remarkably, without a single change order.

Having workers who do what they promise and show up consistently is everything. Remember, loyalty is valuable but not at the expense of quality or efficiency.

When stabilizing a property, you’re not only hiring trustworthy construction crews—you’re also working with lenders. Bridge financing is essential in these scenarios, carrying you to the point where a permanent loan becomes available. Thomas often emphasizes that a supportive, prompt lender can be

more valuable than a slightly lower interest rate. Our initial lenders sometimes dragged their feet, taking three to four weeks to satisfy draw requests, whereas Anchor Loans—in our second round of bridge financing—funded all requests within the same week. Their quick turnaround allowed us to finish the ADUs without further delays, despite paying an 11% interest rate.

Takeaway: Trust your instincts—if something isn’t working, get out early. The sooner you recognize it, the better your chances of course-correcting.

Although each week felt like the dealer was changing out the deck, often with unpredictable wild cards hidden in every new one, I learned you can’t reshuffle the deck or start over. You simply need to keep showing up, stay in front of things, and adapt. In the long run, we will win and generate a good return for our investors. In real estate, as in most other endeavours, only by being in it can one ever be in a position to succeed. The rates will go down, the sinker units that pay next to nothing could move on their own accord, and won’t require a payment of near $100,000, which we were willing to make while stabilizing. The project was all-consuming, and that is the overall lesson here--it has to be.

It took me out of the headspace of wanting to close on other big projects. However, having succeeded in getting the long-term loan in place, I have more confidence in taking on the next project. The lessons and takeaways are far more impactful when in it, than just by streaming a podcast and hearing it from someone else. Not every deal is going to be just as you had planned. An unexpected turn of events can derail you. But in real estate, you always have options. The obstacle can become the way. You just need to keep showing up and play your hand with all your heart.